Homeowners Insurance Explained: Coverage, Costs & Providers In 2025

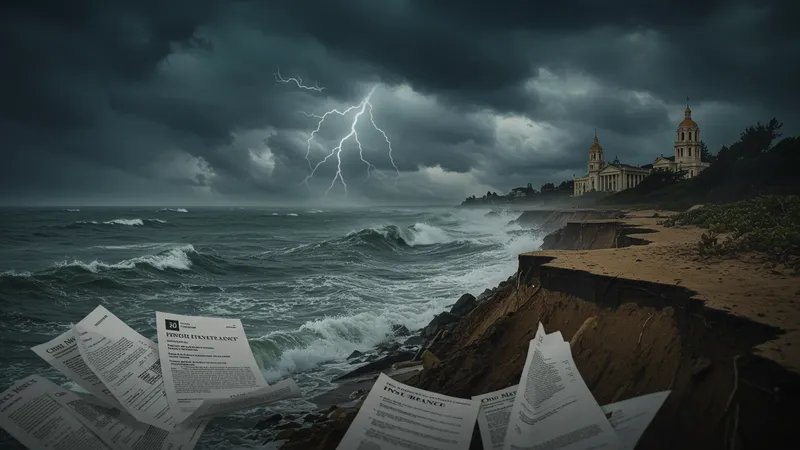

The Role of Climate Change in Evolving Coverage Needs

Climate change undeniably shifts insurance needs in undeniably novel directions — exacerbated severity of storms or floods necessitates explicit expansion. Conventional policies grapple against new environmental realities clamoring at society’s doorstep, urging expanded notions tasking daft exclusion mentality.

Rising sea levels force greater introspection regarding shore property risks already impacting premiums. Legislative responses reflect growing consciousness demanding innovative policy restructuring protecting investment against newfound climate-induced challenges.

Wisdom gained tackles another overlooked reality: extreme temperatures present risks typically associated with natural disasters. With power-grid stresses and infrastructure demands intensifying, fortifying residential resilience against the climate’s wrath feeds into securing investments intelligently.

Open discussions encourage collaborations expanding shared coverages addressing warming realities extending beyond insurance definitions. Shared experiences reveal overcoming dated paradigms, fostering revised preventive tools to mitigate unforeseen exposures marginalized by traditionalist stalemates favoring status quos unjustly.