How Different Types Of Insurance Work

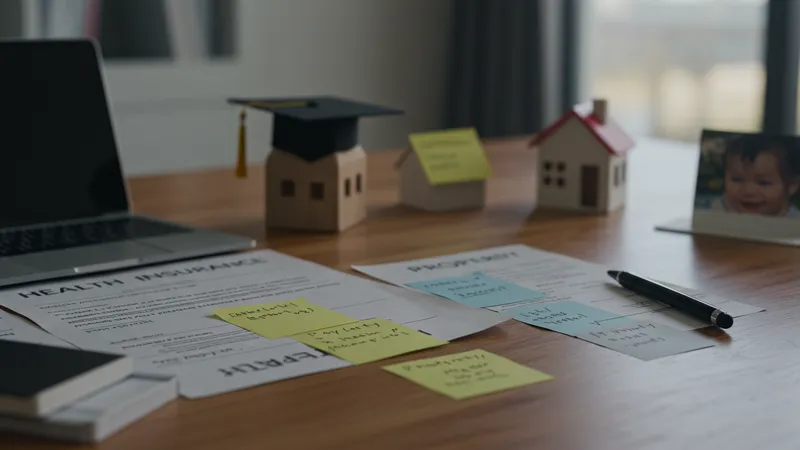

The DIY Approach: Tips for Crafting Personal Insurance Portfolios

Crafting an insurance portfolio isn’t exclusively for agents or financial advisors; with accessibility to resources and knowledge, individuals can build bespoke portfolios tailored to specific needs and life goals.

Begin by identifying essentials—health, life, property, etc. Incorporate personal financial objectives like savings, and align these with corresponding insurance solutions. Incorporate adjustments reflective of your life stages.

DIY portfolio management isn’t without hurdles; critical evaluation of potential risks and regular review cycles inform necessary adjustments and refinements, ensuring continued relevance through life’s unpredictable pathways.

Ultimately, a well-crafted portfolio can foster financial resilience, mitigate risk exposure, and secure greater peace of mind should uncertainties manifest. Learn through integrative insights as we delve further into this comprehensive subject.