How Does Buying Structured Settlements Actually Work?

State-by-State Differences

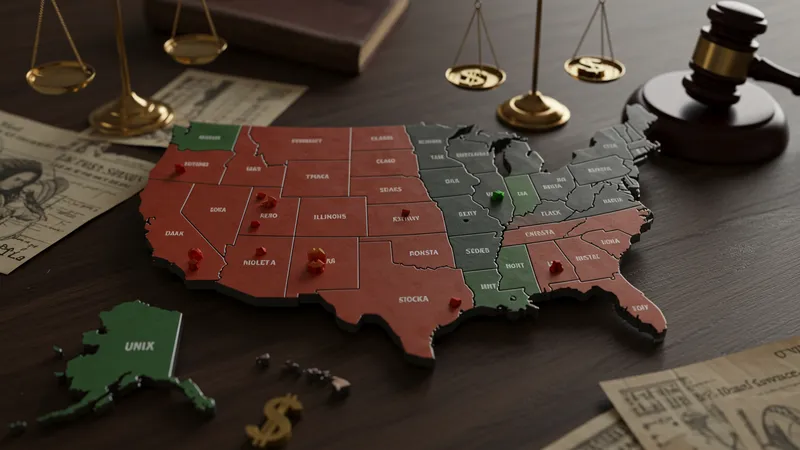

Different states in the US have varied laws and regulations surrounding the sale of structured settlements, which can significantly affect the process and outcome. Some states impose higher taxes, while others have more favorable legislation for sellers.

Understanding these differences can be a deciding factor in the success of your sale. For instance, states like Illinois offer more protection for sellers, while others might present additional hurdles. Could relocating your settlement be an unforeseen strategy?

The quirky and often hidden differences between state tax implications and court approval processes can heavily influence your decision. It’s fascinating what a change of location might entail.

Navigating these state-specific regulations could be complex, but with guided insight, it becomes manageable. The upcoming discussions delve into navigating this legal labyrinth efficiently.